Small Business Tax Preparation Checklist: What to Do Before You File

If you run an agency, consulting practice, or service-based business, you know that tax season stress usually comes from getting your financials in order, not from the filing itself. Between client work, deadlines, and everything else on your plate, finding time to organize a year's worth of financials can feel overwhelming.

This small business tax preparation checklist is designed to help you get organized, avoid last-minute surprises, and file with confidence. The steps work across entity types, though rules vary by state and business structure, so it's always smart to confirm details with your accountant. And if you don’t have an accountant, we’re here to help.

Checklist for Tax Prep

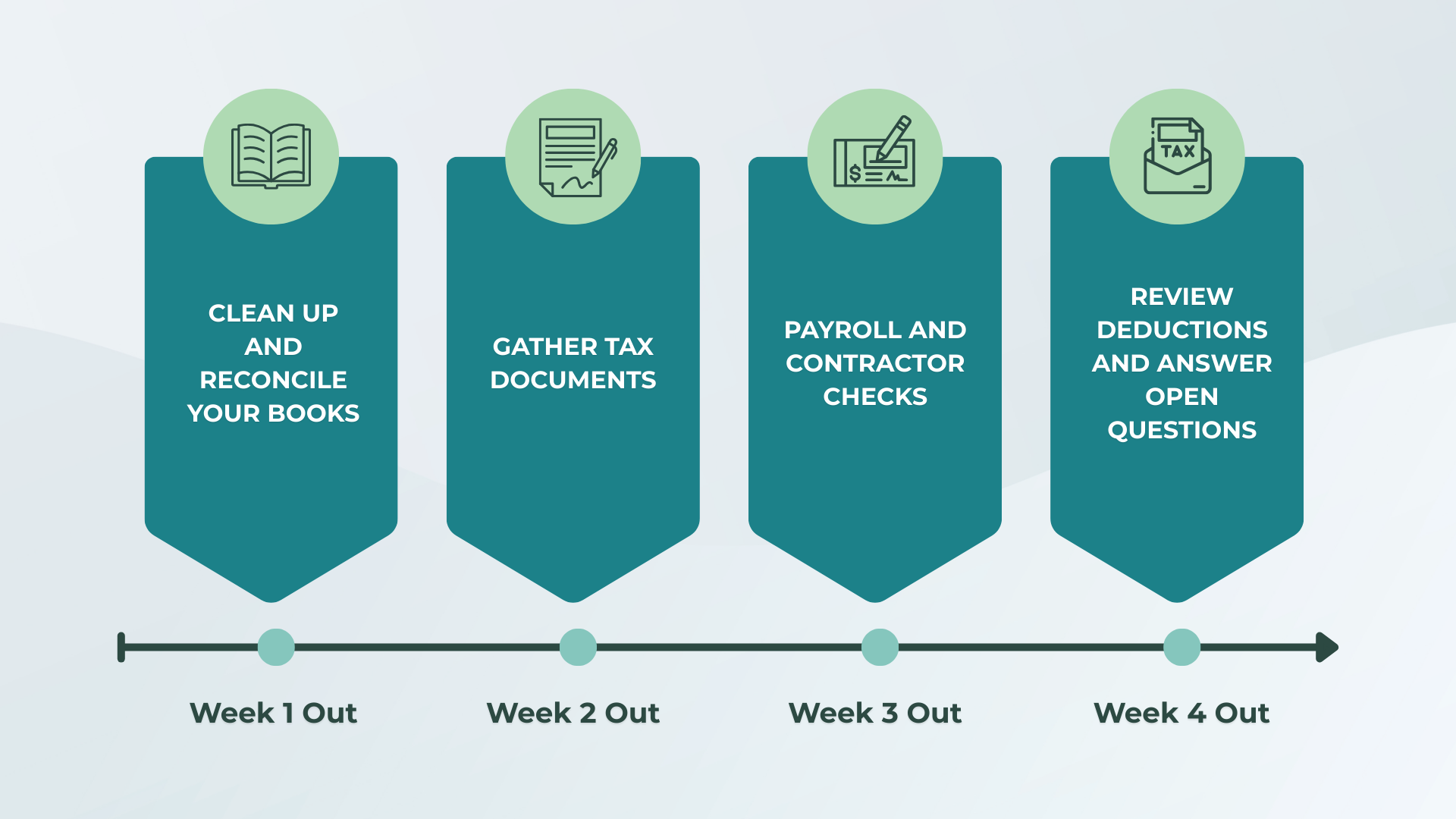

Pick a Ready-to-File Date and Work Backward

Instead of aiming for “sometime before the deadline,” choose a realistic date when you want everything ready for your accountant. Then build your timeline around it.

4 weeks out: books cleaned up and reconciled

3 weeks out: gather tax documents

2 weeks out: payroll and contractor checks

1 week out: review deductions and answer final questions

If you’re behind, start with reconciliation first. It’s the step that makes everything else easier.

Create a Folder System

Save yourself the scavenger hunt. Set up one digital folder for tax season and keep everything in it as you go: bookkeeping reports, banking statements, payroll and contractor documents, receipts for major purchases, sales tax and state filings, and any personal items related to your business (for pass-through entities). Having everything in one place makes handoff to your accountant much smoother and saves you from digging through your inbox in April.

Confirm Your Business Structure and Filing Method

Before you get too far, make sure you know what you're filing as (LLC, S-Corp, partnership, sole prop, or C-Corp) and what return(s) you'll need. This affects deadlines, forms, and what your accountant will request. If you made any changes to your business structure during the year, flag that early on.

Keep a Running Open Questions List

As you work through this checklist for tax prep, jot down questions as they come up. Things like: “Is this expense deductible or should it be capitalized?” or “Do any of these contractors need 1099s?” or “Should we switch mileage methods this year?” or “Does this purchase count as equipment or supplies?” A short list now prevents a lot of back-and-forth later. Answering these questions this year will help your future self.

Clean Up Your Books First

If your books aren't clean, everything downstream takes longer and gets more stressful. This is a great starting point.

Reconcile Every Account Through Year-End

Reconciliation simply means your books match reality. Go through your business bank accounts, credit cards, loans or lines of credit, payment processors like Stripe, Square, or PayPal, and your payroll clearing account, if you have one.

If one account is consistently off, don't ignore it. That's often where duplicate entries, missing transactions, or mis-categorized transfers hide.

Review Revenue for Completeness

All income should be captured and categorized correctly. This means matching deposits to invoices, sales reports, or payment processor activity, separating income types (services vs. product sales vs. other), and confirming refunds and chargebacks are recorded correctly.

Categorize Expenses Consistently

This is where small issues become big time drains. Uncategorized transactions should be cleared out, personal spending should be removed from business books, and unusual or one-time items should have notes added so you remember what they were later.

If you're a creative agency or professional services firm, pay particular attention to how you're tracking contractor costs, software subscriptions, travel, client meals, and project expenses because these categories tend to get messy fast.

Run a Quick Financial Sanity Check

You don't need to be a CPA to spot red flags. Look for big swings compared to last year without a clear reason, negative balances that don't make sense, “Misc” categories that keep growing, and expenses that feel too high or too low for your business.

Gather Your Tax Documents

Once your books are clean, the document collection process becomes much faster and less painful.

Core Business Documents

Have these ready:

Prior-year business return

Profit & Loss and Balance Sheet

Bank and credit card statements

Loan interest statements

Payment processor summaries

Payroll and Contractor Documents

If you run payroll or pay contractors, plan extra time here. Gather payroll summary reports and tax filings, W-2/W-3 copies (or your payroll year-end package), and contractor W-9s with 1099 details.

Owner and Personal Items

Depending on your business structure, your personal return may be closely tied to your business. Common items include estimated tax payments, retirement contributions, health insurance details (if applicable), and documentation for any major changes, such as new entity formation, new state registration, significant purchases, new revenue streams, or the sale of assets.

Year-End Tax Checklist for Payroll and Contractors

Payroll Checks

Before you file, confirm that payroll totals match the books, benefits and reimbursements are recorded correctly, and payroll taxes and filings are complete. If something doesn't match, it's always easier to fix now than after returns are prepared.

Contractor Checks

A few quick steps can prevent 1099 headaches: confirm who needs a 1099 (and who doesn't), verify W-9s and addresses are current, and review contractor vs. employee classification for anyone who feels borderline.

If you're not sure whether someone should be classified as a contractor, add it to your open questions list. Misclassification can create bigger problems than a missing form.

Review Deductions and Credits

This is where organization pays off. The goal is simple: don't miss what you're eligible for, and don't claim what you can't support.

Common Deductions to Confirm

Use this as your small business tax preparation checklist for deductions: home office (if eligible), mileage or vehicle expenses (choose your method and document it), meals and client entertainment (with business purpose and documentation), software and subscriptions, professional services like legal and accounting fees, insurance, interest and bank fees, education and certifications, and professional memberships and associations.

Deductions for Creative and Professional Services Firms

If you're a creative agency, consultant, or service-based business, these categories are often overlooked or mis-categorized: design software, project management tools, client collaboration platforms, industry conferences and networking events, portfolio hosting and website platforms, stock photography or video subscriptions, and coworking space memberships.

If you have a large annual or one-time expense, make sure it's supported with a receipt and a clear business purpose.

Equipment and Major Purchases

Big purchases can impact your taxes, but only if they're tracked correctly.

Build a Simple Asset List

Create a basic list that includes: the item, purchase date, cost, business-use percentage, and where the receipt or warranty is saved. This helps your accountant decide how to treat each purchase (whether to deduct it in full this year or depreciate it over time) and keeps you organized for future years.

Repairs vs. Improvements

Some expenses are straightforward, while others need a quick gut-check. A repair keeps something working; an improvement upgrades, extends life, or adds value. The distinction matters for how you deduct it. When in doubt, don't guess. Again, flag it for your accountant before locking in the category.

Sales Tax and State Requirements

Sales tax can create surprises, especially if you sell in multiple states, sell through marketplaces, offer taxable services, or issue refunds and exemptions.

Do a quick check that sales tax collected matches what you've remitted, refunds and exemptions are handled correctly, and any state-specific filings are complete. Catching errors early is far easier than untangling them after the fact.

Final Checks Before You File

Before you hand things off, do one last pass.

Make sure no uncategorized transactions remain, “Misc” categories are small and explained, documentation is saved for significant deductions, owner compensation and distributions look correct, and estimated payments are recorded. This is also a good time to confirm your contact info, entity details, and that any state registrations are current.

If you’re feeling mostly ready but don’t want to miss anything, download our tax prep checklist. It’s an easy way to confirm you’ve covered the essentials before you send things to your accountant.

Should You File an Extension?

An extension can be a smart move when your books aren't ready yet, you're missing key documents, or you had major changes this year, like a new entity, new state, significant purchase, or big revenue shift.

One important note: an extension gives you more time to file, not more time to pay. If you may owe taxes, you'll still want to estimate and submit payment by the original deadline.

If you extend, set a new internal deadline, keep your open questions list updated, and prioritize finishing your bookkeeping cleanup first.

How KeyLin Advisors Can Help

Tax prep doesn't have to be stressful when you have the right support and a clear plan.

KeyLin can help with bookkeeping cleanup. We reconcile your accounts and organize your books so everything's ready for filing. We also offer year-round bookkeeping so tax season never becomes a scramble, payroll support from setup to year-end compliance, and tax preparation for both business and personal returns.

We keep communication clear and candid, bringing expertise without the jargon. If you want tax season to feel more manageable this year, reach out today, and we'll map out the next steps together.