Minnesota Secure Choice Retirement Program: A Complete Guide for Small Business Owners

Many Minnesotans are worried about retirement and with good reason. A 2025 AARP survey reveals that a significant share of adults over 50 have little or no savings set aside for their future. The Minnesota Secure Choice Retirement Program is one way the state is trying to close that gap while keeping things manageable for small employers.

For Minnesota business owners, the Minnesota Secure Choice Retirement Program offers a practical solution to help employees build financial security while keeping compliance simple for employers.

If you're one of the thousands of Minnesota business owners with 5 to 100 employees, you're probably wondering what the new program means for you. The answer might surprise you: if you have fewer than 25 employees, you likely won't need to take any action until 2027 or later. But you should care now because understanding your options today helps you make strategic decisions that benefit both your team and your bottom line, rather than scrambling to meet a deadline.

Secure Choice isn’t happening in a vacuum. It’s arriving alongside other major changes for Minnesota employers, like the new paid family and medical leave program, starting January 1, 2026, which we’ve covered in our guide on Minnesota Paid Leave.

What is the Minnesota Secure Choice Retirement Program?

The Minnesota Secure Choice Retirement Act created a state-facilitated retirement program designed specifically for employees who don't have access to an employer-sponsored retirement plan, like a 401(k). You can read the full employer-facing description on the Secure Choice employer overview page.

The Basics

Here's what the Minnesota Secure Choice retirement program means in practical terms:

It's a state-mandated program helping employees save who otherwise wouldn't have access to workplace retirement benefits.

Employees save into individual IRAs through automatic payroll deductions.

The program is overseen by the Minnesota Secure Choice Retirement Program Board.

Employees own their accounts and take them when they change jobs.

A Public-Private Relationship

The Minnesota Secure Choice Retirement Savings Plan operates as a partnership between the state and private sector. The Minnesota State Board of Investment oversees the investment options, while Vestwell serves as the recordkeeper managing the employer and employee portals. This structure keeps administrative work off your plate while ensuring professional oversight.

Does the Minnesota Secure Choice Retirement Program Apply to My Business?

Who Counts as a ‘Covered Employer’?

You’re considered a covered employer if you:

Are engaged in business in Minnesota

Have 5 or more covered employees

Have been operating for at least 12 months and don’t currently sponsor a qualified retirement plan, such as a 401(k), SIMPLE IRA, SEP, or certain pensions

When You’re Exempt

Already offering a qualified retirement plan? You're exempt from the Minnesota Secure Choice requirement. However, you'll need to certify that exemption with the state. For example, if you offer a 401(k) plan or SIMPLE IRA, you won't need to participate in the state program.

Key Dates and Enrollment Phases

Here's where timing becomes important. The program rolls out in phases based on employer size, which means you likely have more time to prepare than you think.

Enrollment Phases by Employer Size:

Soft launch (optional): January 1, 2026 to March 30, 2026 for any size employer wanting to enroll early

100+ employees: April 1, 2026 to June 30, 2026

50 - 99 employees: July 1, 2026 to December 31, 2026

25 - 49 employees: January 1, 2027 to June 30, 2027

10 - 24 employees: July 1, 2027 to December 31, 2027

5 - 9 employees: January 1, 2028 to June 30, 2028

What Are My Responsibilities vs. the State’s?

Your Responsibilities as an Employer

Your role in the Minnesota Secure Choice Retirement Program is primarily administrative:

Register with the program or file an exemption during your enrollment phase window.

Provide required notices to covered employees explaining the program and their options.

Enroll employees and set up payroll deductions unless they opt out.

Withhold contributions and remit them to the program within 30 days.

Stay compliant with program requirements to avoid penalties.

What Minnesota Secure Choice Handles

The state program and Vestwell handle the heavy lifting: setting up and servicing each employee's IRA, providing the investment menu, handling investment transactions, maintaining online portals, managing account statements, processing distributions, and handling beneficiary changes. You're not a fiduciary for investment performance, and you cannot make employer contributions into this program. If you want to offer a match or profit-sharing, that’s usually a sign that a separate 401(k), SIMPLE IRA, or SEP may be a better fit.

How the Minnesota Secure Choice Retirement Savings Plan Works for Your Employees

Who’s Eligible

Most private-sector employees age 18 and older working for a covered employer are eligible. The program is designed to be broad and inclusive, covering both part-time and full-time roles.

Roth vs Traditional IRA Options

By default, employees contribute to a Roth IRA with after-tax dollars, meaning they pay taxes now but enjoy tax-free withdrawals in retirement. However, employees can elect a traditional IRA with pre-tax contributions if they prefer the upfront tax deduction.

Contribution Defaults and Auto-Escalation

When Minnesota Secure Choice launches, employees will be enrolled at a default contribution rate set by the program, with the option to change that amount or opt out entirely. The program is also expected to include automatic increases over time to help employees gradually boost their savings, but the exact percentages and schedule will be finalized by the Secure Choice Board before launch. Employees will always be able to log in to their account portal to increase, decrease, or pause contributions.

Minnesota Secure Choice vs. Setting Up Your Own Retirement Plan

This is where strategic planning becomes valuable. While Minnesota Secure Choice provides a no-cost compliance solution, it may not be the best fit for every business.

When Minnesota Secure Choice May Be ‘Good Enough’

The program works well if you want a low-admin, compliant default and aren't ready to offer employer contributions or more complex plan design. It's a practical baseline benefit that meets the legal requirement without significant costs or administrative burdens.

When a Private 401(k), SIMPLE IRA, or SEP May Be Better

If you want higher contribution limits, employer matching, profit sharing, or more plan design flexibility, a private plan typically makes more sense. For businesses competing for talent, a robust retirement benefit can be a significant differentiator.

What Should Minnesota Small Business Owners Do Next?

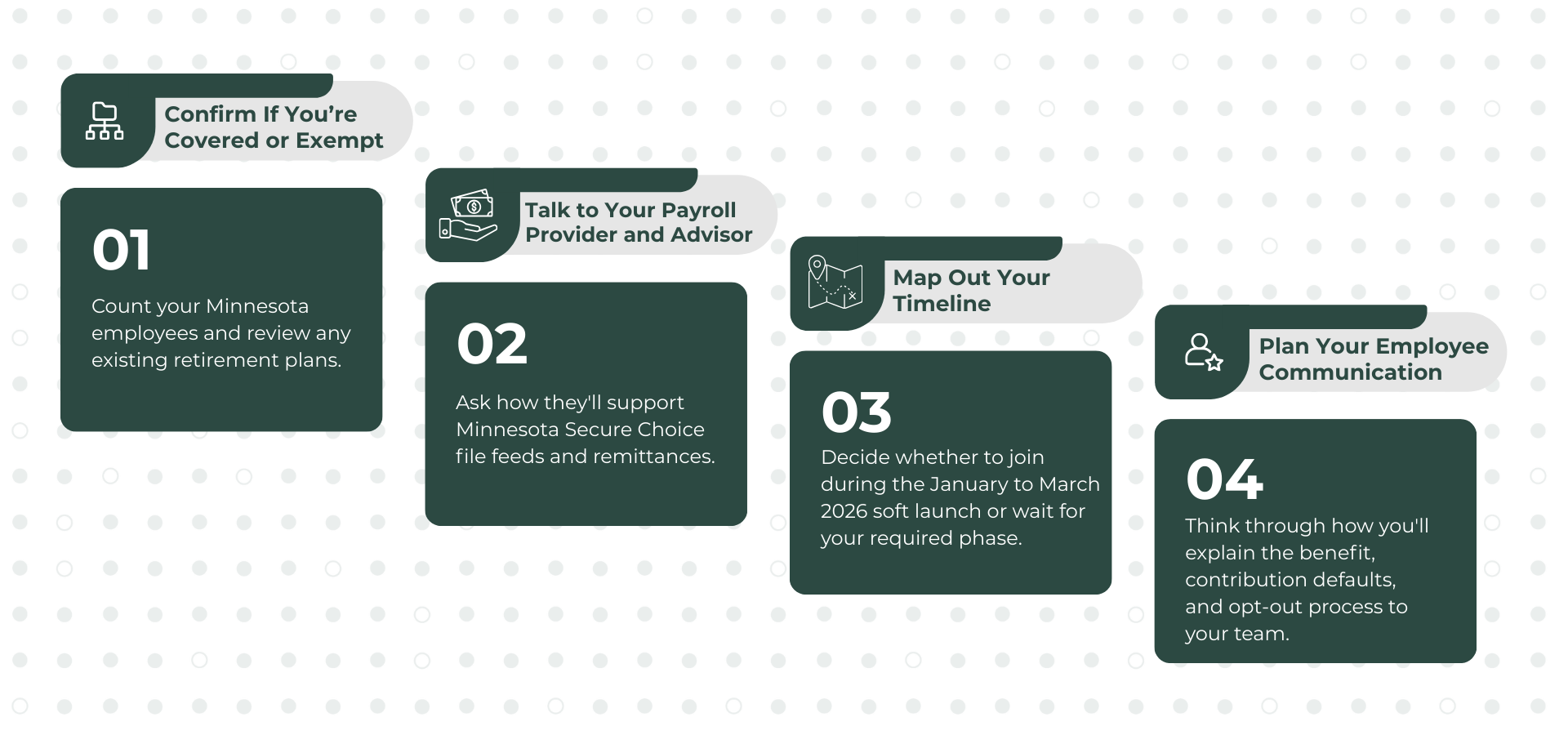

Step 1: Confirm If You’re Covered or Exempt

Count your Minnesota employees and review any existing retirement plans. Even if you're exempt, this is a good time to evaluate whether your current plan still serves your business goals and compensation strategy.

Step 2: Talk to Your Payroll Provider and Advisor

Ask how they'll support Minnesota Secure Choice file feeds and remittances. Discuss whether a private plan might better fit your business than relying on the state program. This conversation often reveals opportunities you hadn't considered.

Step 3: Map Out Your Timeline

Use the enrollment phases outlined earlier to mark your deadline. Decide whether to join during the January to March 2026 soft launch or wait for your required phase. Early adoption gives you time to work out any kinks before the rush.

Step 4: Plan Your Employee Communication

Think through how you'll explain the benefit, contribution defaults, and opt-out process to your team. Frame this as a positive step toward helping employees build long-term financial security. Clear, proactive communication prevents confusion and shows you care about your team's financial wellbeing.

How KeyLin Advisors Can Help Minnesota Employers Prepare

At KeyLin Advisors, we help Minnesota business owners navigate these decisions with clarity and confidence. We can help you determine if you're a covered employer or exempt, compare Secure Choice versus private plan options, coordinate with your payroll provider to implement the program smoothly, and integrate this decision with your broader tax planning, cash flow management, and compensation strategy.

Not sure if Minnesota Secure Choice applies to you or want to explore whether a private retirement plan makes more sense for your business? Schedule a consultation to review your options and make the decision that best supports your team and your business goals.