Cash Flow Management Strategies for Service-Based Businesses

Picture this: Your service business is booming with new clients, projects are rolling in, and your reputation is growing. But despite all this success, you're lying awake at night wondering if you'll have enough cash to make payroll next week. If this sounds familiar, you're not alone, and you're definitely not doomed.

Cash flow challenges hit service-based businesses harder than most, but with the right strategies and tools, you can turn these headaches into growth opportunities. Let's dive into practical approaches that actually work.

Why Cash Flow Matters for Small Businesses

Many small businesses operate on razor-thin budgets, making every dollar count. According to the U.S. Chamber of Commerce, cash flow problems are the number one reason small businesses fail. It's not lack of customers or bad products. It's simply running out of money at the wrong time.

The challenge has only intensified recently. A 2024 Bank of America study revealed that 40% of business owners are reevaluating their spending due to inflation's impact on their operations. This means everyone's tightening their belts, making cash flow management even more critical.

Here's what many business owners don't realize: even profitable businesses can collapse if cash runs dry. You might have $50,000 in outstanding invoices, but if your rent is due tomorrow and clients won't pay for another month, those future profits won't keep your doors open today.

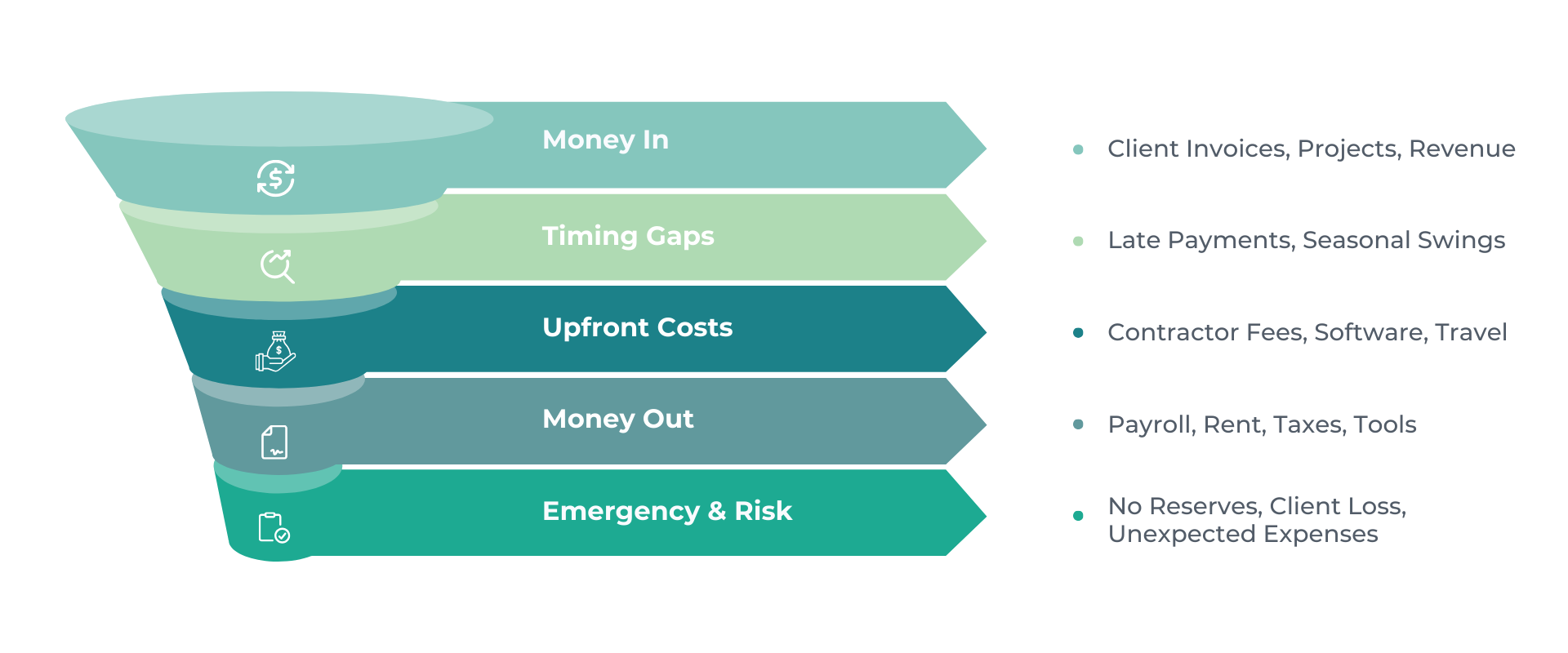

Common Cash Flow Challenges in Service Industries

Managing cash flow in service industries comes with unique hurdles that product-based businesses rarely face. Understanding these challenges is the first step toward solving them.

Seasonal Demand Creates Inconsistent Revenue

Many service businesses experience feast-or-famine cycles. Marketing agencies might see budgets dry up in January, while tax preparation services generate most of their revenue in a four-month window. This seasonal nature makes it difficult to predict when money will actually hit your bank account.

Delayed Client Payments Disrupt Stability

Unlike retail businesses that collect payment immediately, service providers often wait 30, 60, or even 90 days to get paid. Some clients treat your invoice like a suggestion rather than an obligation, leaving you to chase payments while your own bills pile up.

Upfront Project Costs Strain Cash Flow

Whether it's hiring contractors, purchasing software, or covering travel expenses, service businesses often invest their own cash before seeing money from clients. These upfront costs can quickly drain your working capital, especially on larger projects.

Lack of Reserves for Emergencies

When cash flow is already tight, building an emergency fund feels impossible. But without reserves, any unexpected expense, from equipment failure to a major client leaving, can throw your entire operation into chaos.

Building a Cash Flow Strategy That Works

Smart cash flow management isn't about reacting to problems—it's about preventing them before they start. Here's how to build a strategy that actually works for your service business.

Create a Cash Flow Budget

Start by tracking every dollar flowing in and out of your business. This isn't just about recording what happened last month; it's also about planning 12 months ahead. Map out when you expect payments to arrive and when your expenses are due. This simple exercise often reveals patterns you never noticed and helps you spot potential cash issues before they hit.

Forecast Realistically

Use your historical data as a foundation, but don't stop there. Build scenarios for different situations: What if your biggest client pays late? What if you land that major contract you're pitching? What if the economy takes a downturn? These cash flow forecasting tips help you prepare for multiple futures instead of hoping for the best.

Use cloud-based tools

Modern accounting software gives you real-time visibility into your cash position from anywhere. No more waiting until month-end to discover you're in trouble. Cloud-based tools let you check your cash flow from your phone while grabbing coffee, making it easier to stay on top of your finances without drowning in spreadsheets.

How to Improve Cash Flow Quickly

When cash flow problems are already knocking at your door, you need solutions that work fast. Here are proven methods to improve your cash position quickly.

Reduce Expenses Strategically

Not all expenses are created equal. Categorize your spending into essential, important, and nice-to-have buckets. Benchmark your costs against industry standards to identify where you might be overspending. Then tighten the screws where it makes sense, but don't cut too much that you hurt your ability to work with clients or grow your business.

Strengthen Your Accounts Receivable Strategy

Speed up your cash collection by invoicing immediately after completing work. Require deposits on larger projects. Even 25% upfront can significantly improve your cash position. Follow up on overdue accounts consistently and professionally.

Build a Cash Reserve

Start small if you have to, but start somewhere. Even setting aside $500 per month can create a meaningful buffer over time. This reserve becomes your insurance policy against seasonal slowdowns and unexpected expenses.

Use Financing Tools Wisely

A business line of credit can serve as a short-term bridge when cash flow gets tight. The key word here is “short-term.” These tools work best when you know money is coming (like when you're waiting on a large invoice to be paid) rather than as a permanent solution to deeper cash flow problems.

Take Control of Your Cash Flow

Professional CFO services or comprehensive bookkeeping support can provide cash flow forecasts, accounts receivable strategies, and the financial stability you need to focus on growing your business. The right partner brings both technical expertise and industry insight, helping you spot opportunities and avoid pitfalls you might miss on your own.

Cash flow is the lifeline of service-based businesses, but it doesn't have to be a constant source of stress. With proper planning, realistic forecasting, and the right support system, you can transform cash flow challenges into growth opportunities.

At KeyLin Advisors, we understand that managing finances shouldn't feel like a second job. Are you ready to gain confidence in your cash flow? Let's talk about how KeyLin Advisors can help you build a financial foundation that supports your business goals, not just your immediate needs.