Interior Design & Construction Sales Tax in Minnesota: What Small Businesses Need to Know

Sales tax is one of those topics that feels straightforward until you're in the middle of a project and realize you're selling a mix of services, materials, and finished products. If you run an interior design studio or a construction, remodeling, or trades business in Minnesota, you've probably found yourself asking:

“Do I charge sales tax on my design fee, or just on the furniture I sell?"

"What if I buy materials and bill the client? Am I collecting tax from them, or paying it myself?"

"How do local city taxes work? And what about online purchases or out-of-state projects?”

These are the kind of tax questions we hear from small business owners navigating interior design sales tax and construction sales tax for the first time. Minnesota's rules can get tricky fast because you're rarely selling just one thing. You're providing expertise, purchasing products, managing installations, and sometimes doing all three at once, and each piece gets treated differently for tax purposes.

This guide breaks down interior design and construction sales tax in Minnesota in plain language, with practical examples you can adapt to how you actually estimate, invoice, and deliver work.

Quick note: Sales tax rules can get nuanced fast, and every project is a little different. This article is educational and not legal advice. When in doubt, confirm specifics with the Minnesota Department of Revenue or a tax professional. Or reach out to KeyLin if you need help building a sales tax process that works for your business.

Sales Tax Basics for Interior Design and Construction Businesses

What Sales Tax Actually Applies To

Minnesota sales tax applies to most retail sales of tangible goods and some services, including local sales taxes, depending on where the sale is delivered or used.

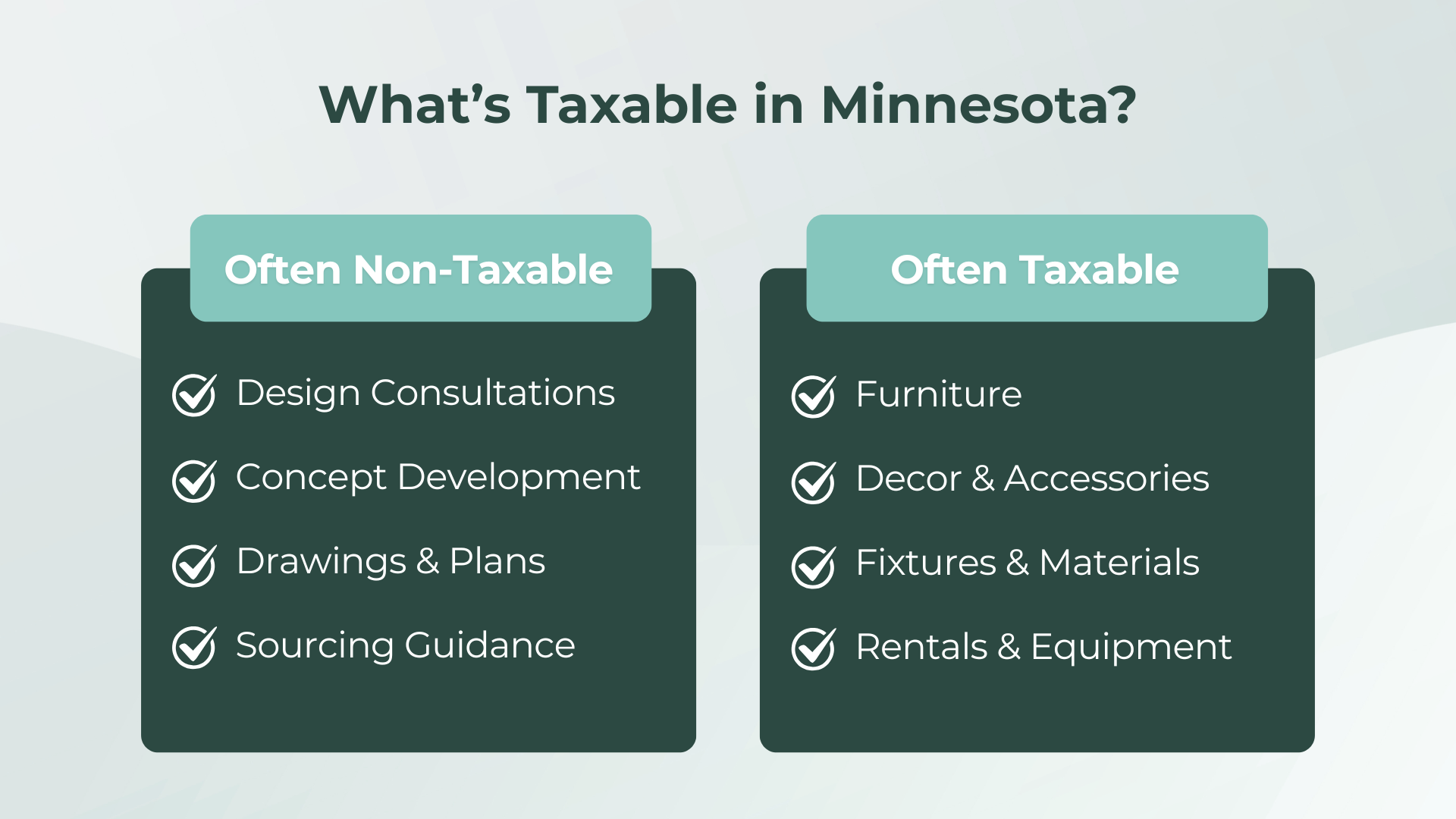

To make confident decisions, you need to separate what you’re providing. Taxable products include tangible personal property like furniture, decor, fixtures, materials, and equipment rentals. Minnesota also taxes certain services, especially “services necessary to complete a sale” in specific situations. Many professional services are not taxable on their own, but the tricky part is when a service becomes tied to a taxable sale, which can change how the entire transaction is treated.

Why Interior Design and Construction Are Complicated

Interior design and construction often blend consulting, purchasing and reselling products, installation and delivery, and materials that become part of real property. Minnesota can treat a service differently depending on whether it's connected to the sale of taxable goods. If you work across state lines or ship goods, you can also trigger tax obligations elsewhere.

Interior Design Sales Tax: Services vs Stuff

What Counts as Taxable for Interior Designers?

Here's the simplest way to think about interior design sales tax: pure design services like consultations, concept development, and drawings are often non-taxable when they stand alone. However, if your design services are tied to the sale of taxable products, Minnesota may treat them as part of the taxable sales price.

Common situations where designers step into taxable territory include designing the space and selling the furniture, fixtures, or accessories to the client, providing a “full-service” package where the design fee connects to taxable item sales, or operating a small retail arm selling products alongside design services.

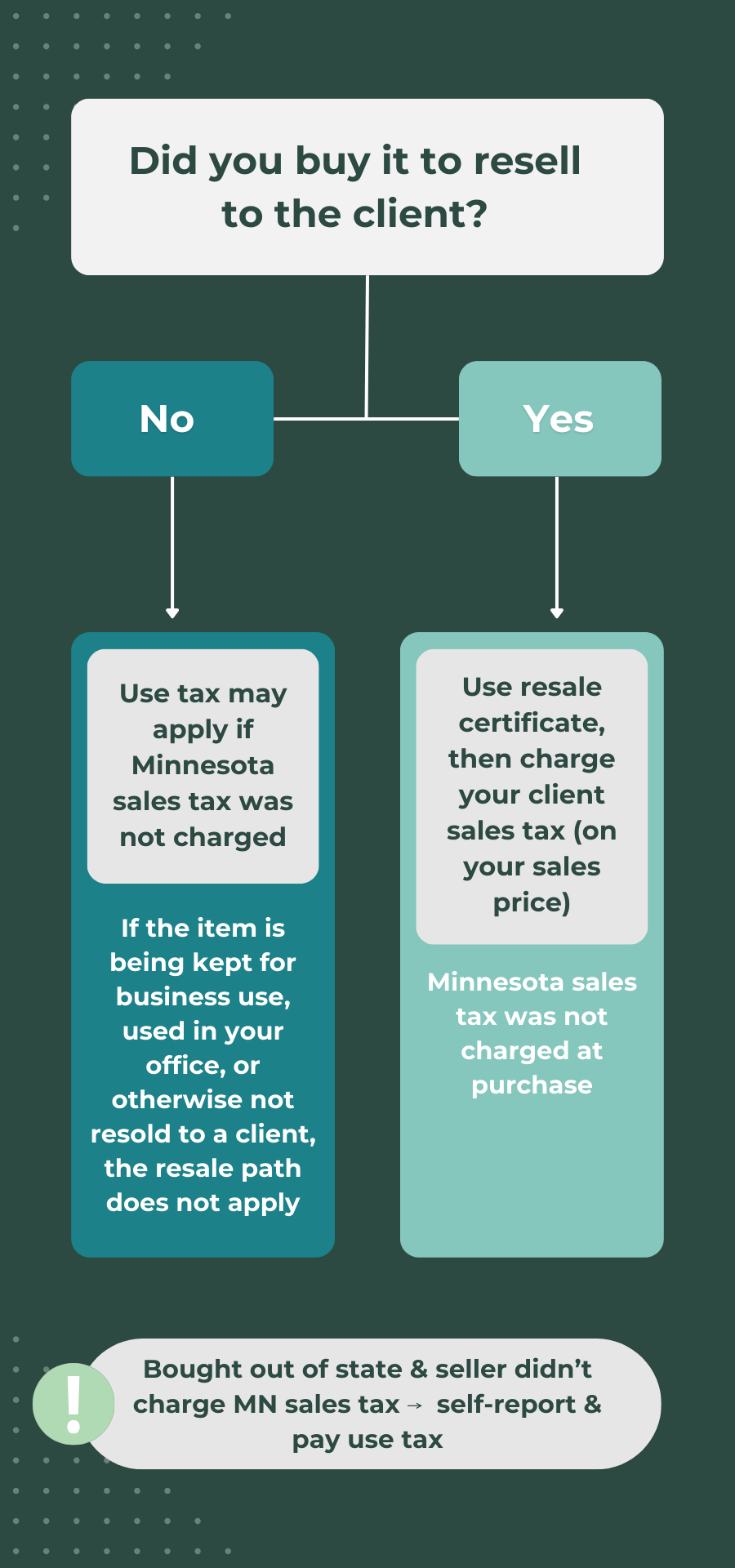

Using Resale Certificates and Markups on Products

If you purchase items for resale, you'll typically buy with a resale certificate when appropriate and then charge the client sales tax on the taxable items you sell. If you sell taxable goods, the tax is based on the taxable sales price you charge to the client, which can include your markup. So if you buy a dining table for $1,000 and sell it to your client for $1,500, you're charging sales tax on $1,500.

Virtual Interior Design and Out-of-State Clients

Virtual work adds complications. If your deliverable is only design guidance and digital plans, the tax treatment depends on state rules and whether those services are taxable. But shipping physical goods to clients in other states creates “where is the product delivered” questions and potentially new-state registration requirements if you cross certain thresholds.

Interior Design Sales Tax in Minnesota

How Minnesota Treats Interior Design Services

Minnesota’s guidance on interior design sales tax in Minnesota is clear: interior design services can be taxable when tied to the sale of taxable goods or services from the same business, even if the fee is separately stated. You can't always “make it non-taxable” by splitting the invoice into separate lines if the design work is clearly connected to selling taxable items.

Common Minnesota Scenarios for Designers

Three situations come up frequently. First, if you charge a flat design fee and the client buys furnishings directly from vendors, you may only be billing for services. However, if you buy and resell those furnishings yourself, you're now selling taxable goods. Second, when you bundle design services with furnishing sales under a comprehensive project fee, Minnesota may treat a larger portion of the project price as taxable. Third, if you sell a retail line (pillows, candles, art) alongside services, those retail sales are typically taxable, so separate documentation becomes important.

Avoiding Common Minnesota Interior Design Sales Tax Mistakes

Along with these three common scenarios, there are the main mistakes that cause the most pain. First, not charging tax on taxable furnishings or other tangible items you sell. Second, misusing resale certificates by using them for items you end up keeping for your own office. Third, missing use tax on out-of-state vendor purchases when Minnesota sales tax wasn't charged.

Construction Sales Tax: Contractors, Trades, and Remodelers

Are You a Contractor or a Retailer (or Both)?

For Minnesota construction sales tax, the core distinction is whether you’re acting as a contractor improving real property or as a retailer selling taxable goods. Minnesota’s contractor guidance is clear: contractors generally pay sales and use tax on materials, supplies, and equipment used to complete a construction contract, with tax applied at the time of purchase. This is different from retail, where you buy inventory tax-free for resale and then collect sales tax from customers.

Materials, Labor, and Real Property

Minnesota treats many contractors as the end users of the materials they incorporate into real property. That’s why the tax often shows up when you buy materials, not as a separate sales tax line on the customer invoice. Factors that change this include whether you're doing new construction or remodeling, residential or commercial work, and what specific items are being installed.

Subcontractors, Equipment, and Change Orders

Subcontracted work raises questions about who is responsible for tax on materials, depending on who purchases what and how the contract is structured. Equipment rental, delivery, and installation can be taxable depending on what's being billed and how it's stated. Change orders need careful attention because if they add taxable items or change what you're selling, your invoicing should reflect that clearly.

Multi-City and Multi-State Projects

Understanding Nexus in Simple Terms

Nexus is the connection that creates a sales tax obligation in a state, created by physical presence (employees, inventory) or economic activity (sales thresholds). In Minnesota, remote sellers must generally collect and remit sales tax if they exceed either 200 or more retail sales shipped to Minnesota or more than $100,000 in retail sales shipped to Minnesota in the prior 12 months.

For designers and contractors, this matters when you start doing regular work outside your home state. Occasional out-of-state work where the client buys locally is often simpler, but regular out-of-state projects that involve shipping goods or maintaining crews typically require registration, collection, and ongoing filings in that state.

Invoicing Clients Without Confusing Them

How to Show Sales Tax on Interior Design Invoices

A client-friendly invoice for interior design sales tax should have clearly separated lines for non-taxable services versus taxable products, plain-English descriptions, and sales tax applied only where appropriate. For example, show “Design consultation and space planning” as one line, then “Dining chairs, set of 6” as a separate line with sales tax calculated on the chairs but not the consultation fee.

Avoid vague descriptions like “Project fee” or “Furnishings.” The more detailed your invoice, the easier it is to defend your tax treatment and the less stress you’ll endure.

How to Show Sales Tax on Construction Bids and Invoices

For many Minnesota contractors, sales tax is handled at the time of material purchase, not as a “sales tax collected” line from the client, because you're the end user of the materials. Your bids should account for that cost to protect your margin. If you're paying 6.875% sales tax on $10,000 worth of materials, that's $687.50 that needs to be built into your project pricing.

When you do need to show sales tax to the client (on certain installed items or equipment), use the correct tax rate for the delivery location, especially if local add-on taxes apply.

Deposits, Retainers, and Long Projects

If a project spans months, be consistent in how you treat deposits and progress billing. Keep documentation tight so you can support what's taxable versus not taxable, especially if your scope changes midstream. Decide on an approach, like applying sales tax proportionally to each progress payment, and stick with it throughout the project.

Use Tax, Resale Certificates, and Online Purchases

What Use Tax Is and When It Applies

Use tax is the “backstop” when sales tax wasn't charged at purchase, but the item is used in Minnesota. Common triggers include buying taxable items online where no tax is charged, purchasing out-of-state and bringing items into Minnesota, or withdrawing inventory for business use instead of resale. If you buy materials or furnishings from an out-of-state supplier that doesn't charge Minnesota sales tax, you're responsible for calculating and remitting use tax.

Common Sales Tax Mistakes We See and Quick Fixes

Interior Designers’ Most Frequent Missteps

Treating product-heavy projects like they’re purely service-based

Quick fix: Map each revenue line to “service” versus “taxable goods,” then invoice accordingly. If you're selling $15,000 worth of furniture alongside a $3,000 design fee, those need to be clearly separated and taxed appropriately.

Not documenting what's taxable versus non-taxable on invoices

Quick fix: Standardize your descriptions and line-item structure. Create invoice templates for common project types.

Ignoring multi-state rules for virtual services plus shipped goods

Quick fix: Track shipping destinations and sales volume by state. Review your out-of-state sales quarterly to catch nexus issues before they become problems.

Construction Sales Tax Pitfalls

Assuming all construction labor is non-taxable without checking the “what are you installing” rules

Quick fix: Use Minnesota's contractor resources to validate special cases. Some installation work is treated differently depending on what's being installed.

Not tracking tax paid on materials for mixed-use jobs

Quick fix: Job-cost your materials and keep vendor invoices tied to the job file.

Missing local add-on taxes

Quick fix: Use Minnesota’s local tax guidance and rate tools when delivering taxable goods into local tax areas.

Need Help?

Sales tax compliance doesn’t have to be perfect to be strong. What matters is that your approach matches how you actually sell, whether that's design services, product procurement, installation work, or job materials.

If you're not sure whether a fee is taxable, whether you should be using a resale certificate, or how to handle use tax and local taxes, KeyLin can help you set up a process that's clear, defensible, and easy to run month-to-month. We work with interior designers and construction businesses throughout Minnesota to build financial systems that work in the real world.

Ready to get your sales tax process sorted? Contact our team or schedule an appointment to talk through your specific situation.