Accounting Solutions for Franchise Owners

Running a franchise is a balancing act. On one hand, you’ve bought into a proven business model. On the other hand, you’re still managing the same complex financial responsibilities as any other small business, plus a few extras.

From royalty fees to corporate reporting requirements, franchisees face unique accounting challenges. In this article, we’ll walk through what makes franchise bookkeeping different, strategies to simplify your process, and how the right accounting partner can help you stay focused on growth.

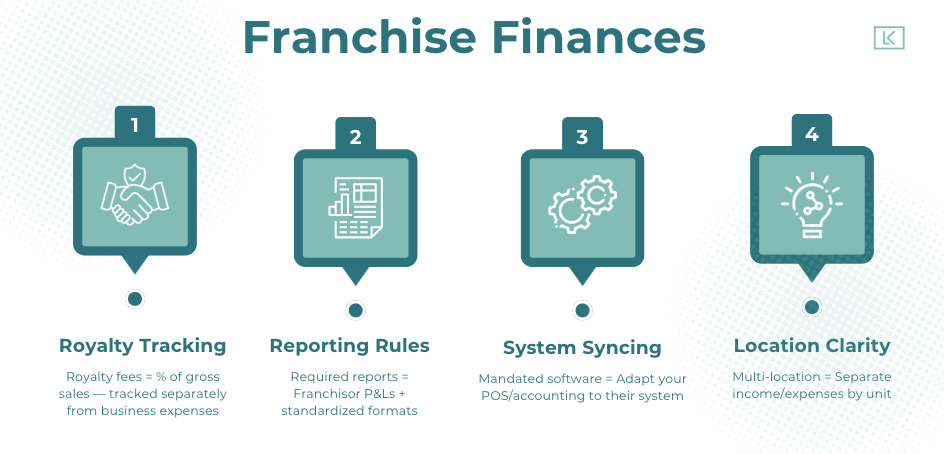

What Makes Franchise Bookkeeping Different?

Owning a franchise gives you access to an established business model, but your books won’t balance themselves. One major difference is the need to track and report royalty fees—usually a percentage of gross sales—plus required contributions to national marketing funds. These payments often occur on a monthly basis and must be documented separately from standard business expenses.

Additionally, franchisors typically enforce strict reporting requirements, including formatted profit and loss (P&L) statements and sometimes mandated accounting systems. If you’re managing multiple locations, you also have to separate income and expenses by unit to track performance clearly. And if the franchisor mandates a point-of-sale (POS) or bookkeeping platform, you may have to adapt your internal processes to match.

These complexities make it critical for franchisees to set up clean, franchise-specific accounting systems from day one.

Building a Solid Accounting Foundation

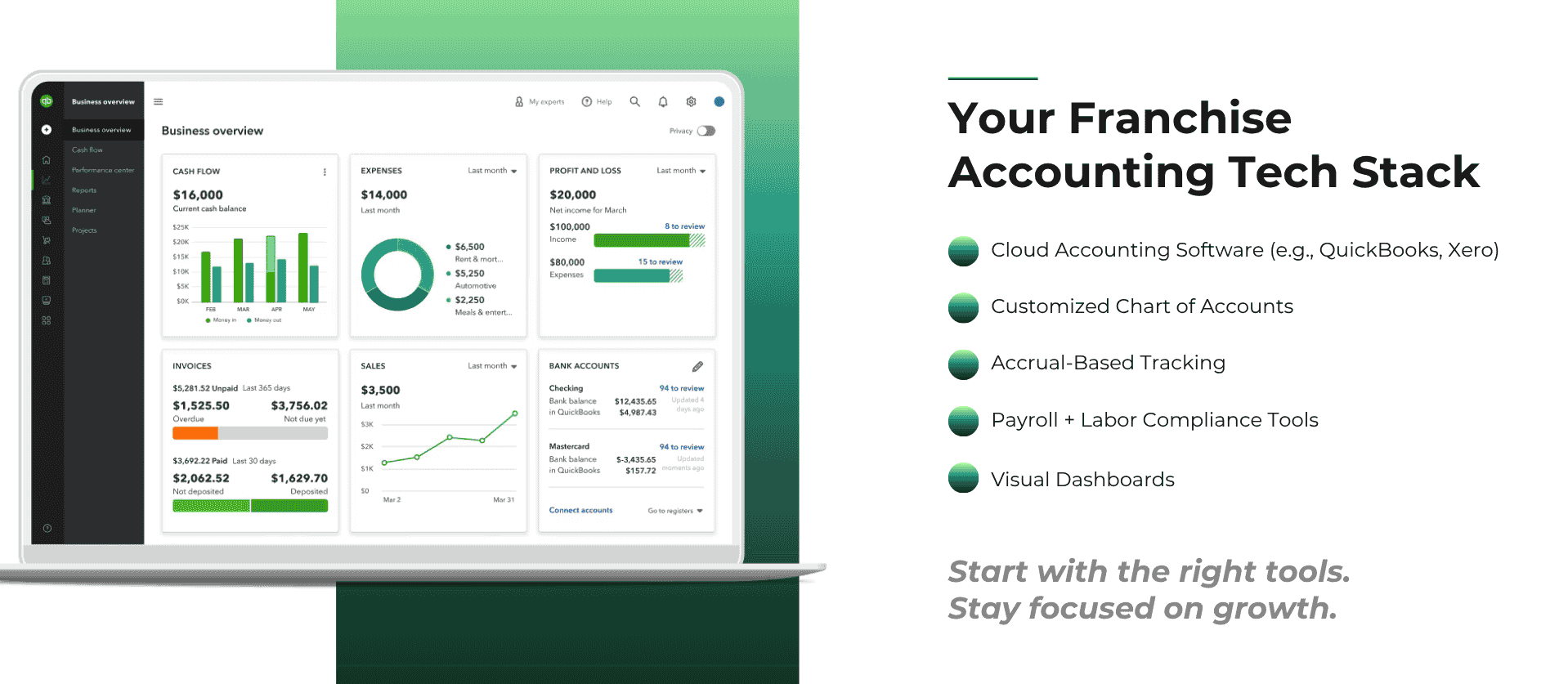

Strong franchise accounting services go far beyond tracking sales and expenses. The right system is built around your specific needs as a franchise owner.

For example, most franchises benefit from a customized chart of accounts that aligns with both business operations and franchisor reporting guidelines. If your industry involves physical inventory—like retail or quick-service restaurants, you’ll need to closely track cost of goods sold (COGS), returns, and vendor payments.

Franchisors often require accrual-based accounting rather than cash-based, which means revenue and expenses are recorded when earned or incurred, not when money changes hands. This gives a more accurate financial snapshot but also adds complexity, especially when it comes to managing things like deferred revenue or prepaid expenses.

Integrated payroll tools are also essential. These allow you to manage wage compliance, benefits, and tax filings, especially if you operate in multiple states or cities with varying labor laws.

Ultimately, the goal of franchise bookkeeping is two-fold: to maintain compliance with franchisor requirements and to provide you—the owner—with clear, actionable financial data.

Strategies for Multi-Location Bookkeeping

If you operate more than one unit, your bookkeeping needs to scale with your business. Here’s how to stay organized:

Centralize with cloud-based software like QuickBooks Online or Xero, which allow for multi-entity tracking.

Tag income and expenses by location, using classes or projects, so you can see which units are thriving and which need attention.

Automate recurring transactions, such as royalty payments or monthly subscriptions, to reduce manual entry and avoid missed deadlines.

Build visual dashboards that help you compare key metrics like revenue per square foot, labor ratios, or profit margins between units.

Standardizing financial workflows across locations is essential for consistency, scalability, and franchisor satisfaction.

Franchise Financial Management Tips

It’s easy to treat bookkeeping as a compliance task, but it’s much more powerful as a business tool. Effective franchise financial management helps you make confident, proactive decisions.

First, establish a regular rhythm for reviewing your financials. Monthly reviews give you visibility into trends—like rising costs or lagging sales—before they become major issues. Use this time to review budget vs. actuals, spot high-spending categories, and plan cash flow.

Franchisees should also plan for seasonality. Whether you’re in hospitality, education, or retail, knowing your off-peak months lets you build a cash cushion when times are good.

And don’t underestimate the power of benchmarking. Comparing your numbers to other units, if available, can reveal where you’re overspending or underperforming. Even without access to system-wide data, watching your own year-over-year or quarter-over-quarter trends offers insight.

When it comes to reinvesting in your business, whether that’s hiring, training, or launching a new marketing push, your financials should drive those decisions, not gut instinct.

Smart Tax Planning for Franchisees

Franchise tax planning isn’t just about annual filings—it’s an ongoing part of your financial strategy. Keep these tips in mind:

Track startup and franchise fees: Many of these can be amortized over time, reducing early-year tax pressure.

Separate personal and business expenses: This helps you stay audit-proof and maximize legitimate deductions.

Know your entity type: Whether you’re an S-corp, LLC, or sole proprietor, your structure affects how you’re taxed and how you plan.

Stay on top of estimated payments: Most franchisees owe quarterly taxes. Falling behind means penalties and cash flow stress.

Run the Numbers, Not Just the Business

Owning a franchise offers a strong foundation, but your success depends on how well you manage the details, especially your finances. With the right systems in place, your books become more than a tool for compliance; they become a lens into your business’s health, challenges, and opportunities.

At KeyLin Advisors, we help business owners gain clarity, stay organized, and make confident financial decisions. Our team understands the complexities that come with managing multiple locations, navigating corporate requirements, and planning for long-term growth. If you’re ready for a financial partner who brings both insight and simplicity to the table, we’re here to help.